is property tax included in mortgage ontario

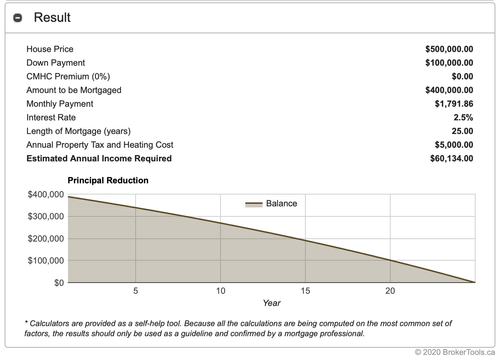

For example a Toronto homeowner with a property valued at 500000 would pay 305507 in property taxes based on the citys rate of 0611013 the lowest on the list. 2020 Education Tax Rate for Residential Properties in Ontario.

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Hey all been a while since Ive posted but keep reading and learning.

. Get Accurate Quotes Not Estimates. Property tax included in mortgage payment issue. GSTHST new housing rebate.

You usually pay these costs by the time the sale is completed or closes. If you dont you put yourself at risk of mortgage liens or foreclosure. See How Much You Can Save.

If the builder has included the GSTHST in the purchase price then itll automatically be included in your mortgage. Ontario administering the property tax is certainly one of the most importantnot least because the property tax is the single biggest source of revenue for municipalities. Some cities may add additional taxes.

In comparison a similarly-priced home in Windsor which has the highest tax rate of 1818668 would have a tax bill of 909334. In certain cases it can be based on the fair market value of the land. Remember that this amount cannot be added to your mortgage payment.

Property taxes like income taxes are nonnegotiable meaning you have to pay them. With cash on closing day or through your mortgage. Dont forget though if you have any questions or would like to make any changes within your current mortgage Im always happy to take the.

A mortgage lien is a claim to your property until you make good on your liability in this case property taxes. Notwithstanding its importance as a revenue source the property tax and its associated legislation continues to increase in complexity. It is usually calculated based on the sale price of the land and property.

So our mortgage with BMO includes the property tax component approx 95biweekly payment and this has recently changed to 185bi-weekly payment because its not enough to cover the property tax on the property. The new better way to get a mortgage in Canada. If you pay your real property taxes by depositing money into an escrow account every month as part of your mortgage payment make sure you dont treat the entire payment as a property tax deduction.

While your local government charges property taxes every year you can pay them as part of your monthly mortgage payment. Once cost often overlooked by both first-time homebuyers and seasoned homeowners is your monthly share of your property tax bill. Having income from a long-term salaried position is the easiest way to qualify for a mortgage.

Your income can be proved easily through an employment letter and recent pay. Ad Choose the Best Mortgage Option Right For You. These are called closing costs.

When you buy a home you have to pay for upfront costs in addition to your mortgage. Apply Now To Enjoy Great Service. However there are some times when this is not ideal.

Ad Highest Satisfaction for Mortgage Origination. As a rule of thumb you should budget 1-15 of your property value for Land Transfer Tax. Complete Our Fast Online Process Get Pre-Qualified.

The following fees are SOMETIMES included in the APR check your compliance department for these. If you incur legal fees to buy your rental property you cannot deduct them from your gross rental income. If you dont pay your taxes the county can put a lien on your property.

Ad Get a low rate save on interest and get help from our Mortgage Advisors when you need it. What Im trying to figure out is whether I will actually have taxes due in cash on closing or whether the remaining tax amount the HST charged less the rebate will be included in my mortgage. Here are some of the most common types of income that you can use to qualify you for your mortgage some of which may give you more buying power than you think.

Professional fees includes legal and accounting fees You can deduct fees for legal services to prepare leases or collect overdue rents. But if the sign says 500000 HST you need to be prepared to pay for the tax up front. Every month you pay a portion of your property taxes on top of your monthly mortgage payment and your lender usually saves up those payments in a separate account called an escrow.

Property tax rates also depend on the type of. Instead divide the fees between land and building and add them to their respective cost. Credit life insurance insurance that pays off the mortgage in the event of a borrowers death The following fees are normally.

Generally only the amount that the bank or lender reports to the Internal Revenue Service IRS often noted on Form 1098 qualifies for the deduction. Now theres one of two ways youll have to pay this. I understand from this thread that the calculation goes like this assuming this is.

Whichever option you decide upon will be a personal choice that suits your own needs and lifestyle though typically most homeowners will pay their property taxes through their mortgage as the pros tend to outweigh the cons. Applying online is quick and easy. For example the City of Toronto has a City Building Fund Levy that is used for public transit and housing projects in Toronto.

Most of the time your lender will collect property tax in your mortgage payment then pay your municipality on your behalf. However its important to note that a. You can expect to spend between 15 and 4 of the homes purchase price on closing costs.

Buying An Investment Property For Student Rentals In Ontario Mortgage Broker Life Insurance Wealthtrack

Should You Pay Property Taxes Through Your Mortgage Ratehub Ca

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Paying Property Taxes Avoid A Big Bill Options To Make It Easier My Money Coach

6 Helpful Tips For Mortgage Shopping Helpful Hints Mortgage Mortgage Brokers

Ontario Property Tax Rates Calculator Wowa Ca

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Latest Latest Business News Mortgage Applications Drop With Rates At Two Year High Real Estate Rentals Commercial Real Estate Real Estate Marketing

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

Do I Have To Pay Property Taxes Through My Mortgage Ratesdotca

Home Loan Document Checklist Prosperity Home Mortgage Llc Home Mortgage Mortgage Loans Mortgage

Porting Assuming Or Breaking A Mortgage What You Need To Know

Condo Vs House Current Mortgage Rates Condo Mortgage Rates

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Free Broker Price Opinion Form Printable Real Estate Forms Real Estate Forms Cover Letter For Resume Letter Example